What is a consolidation loan and why might you need one?

A consolidation loan, also known as “regroupement de crédit ” in French, is a type of loan which combines multiple debts into one. With these loans, people can roll all their debt into one payment that usually has a lower interest rate than the other individual debts.

The reason for taking out a consolidation loan could be to reduce monthly payments, overall debt or to get a better interest rate. Paying off high-interest loans through a consolidation loan is something many people do, to help them save money over the long term.

Types of Consolidation Loans

There are two main types of consolidation loans: secured and unsecured. Secured consolidation loans allow individuals to borrow against an asset, such as a house or car, to use as collateral. Unsecured consolidation loans generally require no collateral, but they may come with higher interest rates and shorter repayment terms.

The amount a person can borrow with a consolidation loan varies by lender. Some lenders offer larger loans, while others will limit how much a borrower can take out. Typically, a borrower can have anywhere from $5,000 to $50,000 in debt available for consolidation.

Other Reasons For Choosing a Consolidation Loan

Other than saving money, there are many other reasons to consider getting a consolidation loan. By consolidating your debt, you’ll make it much easier to manage and pay down your overall debt faster. You may also be able to negotiate lower interest rates with your lender if you take advantage of a consolidation loan offer.

In addition, consolidating your debt can help improve your credit score. When you apply for a consolidation loan, the lender will pull your credit report to determine your creditworthiness. If you make your payments on time and manage your debt wisely, the loan can help boost your score.

Things to Consider Before Applying for a Consolidation Loan

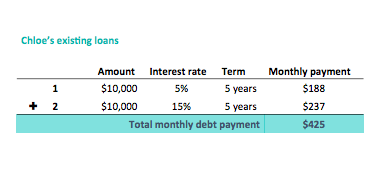

When considering whether or not to take out a consolidation loan, there are some important factors to consider before making a decision. The first thing you should do is calculate what your total debt is and the amount of money you owe each month. This will give you a good idea of how much debt you can realistically payout in a consolidation loan.

Next, you should look at different consolidation loan offers and compare interest rates, fees, and repayment terms. Keep in mind that some lenders may charge processing fees or origination fees, so you should factor these into the cost of the loan.

Finally, you should think about whether taking out a consolidation loan will help you achieve your financial goals. For instance, if you want to reduce your monthly loan payments and free up more money each month, taking out a consolidation loan may be worth looking into. However, if you want to pay off your debts sooner, then a consolidation loan may not be the best route for you.

Consolidation loans can be a great way to get out of debt and simplify your monthly payments. But before you make any decisions, make sure you do your research and factor in the costs associated with taking out a loan.